Reinventing insurance from scratch and acquiring 40% of the millennial segment

Young insurance customers were expected to become the dominant segment by 2020. However, more than 30% of them are still not insured and seem to have given up on getting insurance because it seems too complicated and they believe its value is too low.

One of Scandinavia’s largest insurance companies, Tryg, realized that in order to remain relevant in the market and attract younger customers, specifically millennials, they had to step out of their comfort zone and develop a different kind of insurance specially designed for them.

For many potential clients in the insurance industry, dealing with insurance is complex, too demanding, and a bit boring. At Tryg, they decided to face their internal limitations, innovate significantly, and overcome this challenge. The goal was to find solutions that could replace the bureaucracy and unnecessary obstacles associated with insurance with technology, making it more accessible.

annual revenue growth

retention rate

first-time home insurance buyers

How we validated and built a new business

As usual, during the early phases of our Venture Building projects the team spent many hours researching the target market and getting to know potential clients better. Different buyer personas were identified and through conversations with them we discovered more insights about their needs, wants, and fears related to insurance. Our team also invested a lot of time speaking with key Tryg employees to gain a deep understanding of the various aspects of running an insurance company.

After all these weeks of work, we ended up with a proposal with different solutions to address the problem. We prototyped the possible solutions with potential customers with the aim of launching a Minimum Viable Product (MVP) after having gone through a rapid cycle of “test-learn-adapt”.

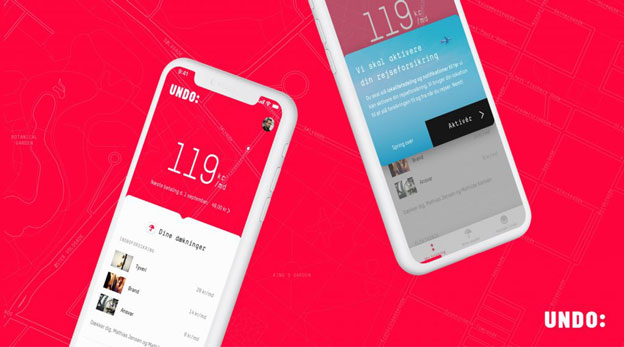

Undo: a tech startup that makes insurance, not an insurer with an app

From its conceptualization, Undo's mission was to reinvent insurance by making it simple, personalized, and purely mobile. The entire process, from purchasing an insurance product to making a claim and detecting fraud, can be completed in a few minutes through the app.

Undo tailors insurance policies to each client and was one of the first in Europe to do so. It customizes the product according to the data of each client and relies on algorithms developed internally in Undo, while Tryg provides historical and value data. The user only has to answer a maximum of 8 questions and receives an instant response with a personalized package thanks to an Artificial Intelligence system.

An attractive insurance product for millennials

In May 2018, Undo was launched in the Danish market with a product that has grown rapidly since then. An attractive insurance product for the younger generation, 90% of the clients are between 20 and 35 years old. 68% of these new policyholders had never purchased insurance for their homes before.

Thanks to its innovative concept, Undo has been awarded several times and is currently growing significantly faster than other insurers in Denmark. In addition, this growth is expected to reach the next level with an innovative car insurance product to be launched soon.